Principal and Income Payment Timeliness Project Example

Principal and Income Payment Timeliness Project Example

Couldn't load pickup availability

Depository Trust Co. (DTC) Six Sigma project dropped defect rates associated with open balances by 19% and cycle times for resolving open balances were shortened by more than 40%

--

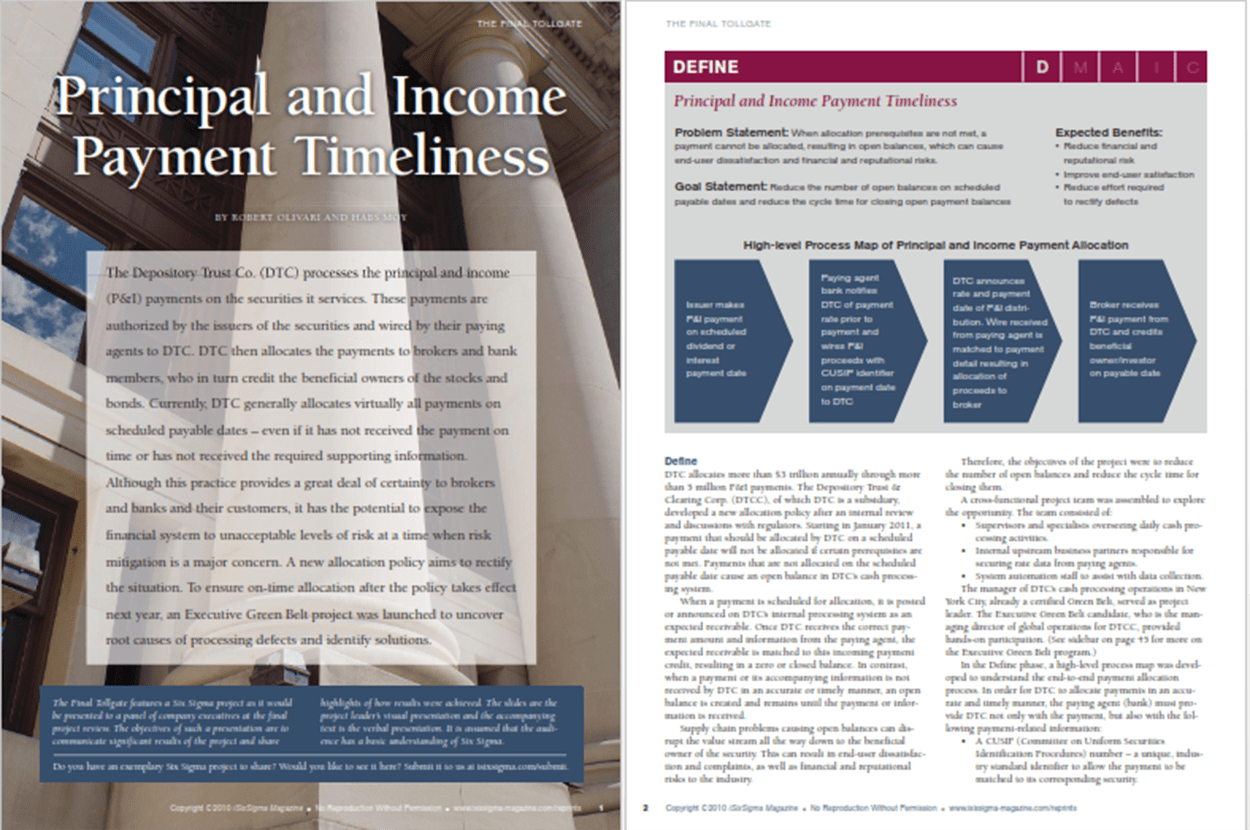

This Six Sigma project, featuring experiences at The Depository Trust Co. (DTCC) in New York, sought to mitigate financial and reputational risk by ensuring allocation prerequisites are met, thus reducing the open balances.

As a result of this DMAIC project, defect rates associated with open balances dropped by 19 percent; cycle times for resolving open balances were shortened by more than 40 percent; and total effort required to close open balances decreased by 40 percent. Completing this project has enabled DTCC's Principal & Income Cash Processing Operations to note variations when they occur and initiate more timely actions to resolve those issues.

The Depository Trust & Clearing Corp. (DTCC) processes the principal and income (P&I) payments on the securities it services. These payments are authorized by the issuers of the securities and wired by their paying agents to DTC. DTC then allocates the payments to brokers and bank members, who in turn credit the beneficial owners of the stocks and bonds.

As a result of the project, defect rates associated with open balances dropped by 19 percent, declining from 21.9 percent to 17.7 percent. Likewise, cycle times for resolving open balances were shortened by more than 40 percent, from 22.1 business days to 12.6.

Additionally, the total effort required to close open balances decreased by 40 percent, since fewer open balances were occurring after improvements were implemented.

[caption id="attachment_17178" align="alignnone" width="1250"] Sample image for project example[/caption]

Sample image for project example[/caption]

Open Source Six Sigma

More products from iSixSigma